This is part of a special series, brought to you by the Standards for Excellence Institute, to provide nonprofit leaders with a brief nonprofit governance and management tip weekly over the course of 2020. We hope these short tips will be helpful to you and the nonprofits you serve. If you have suggestions for future topics, please forward these to acmadsen@standardsforexcellence.org.

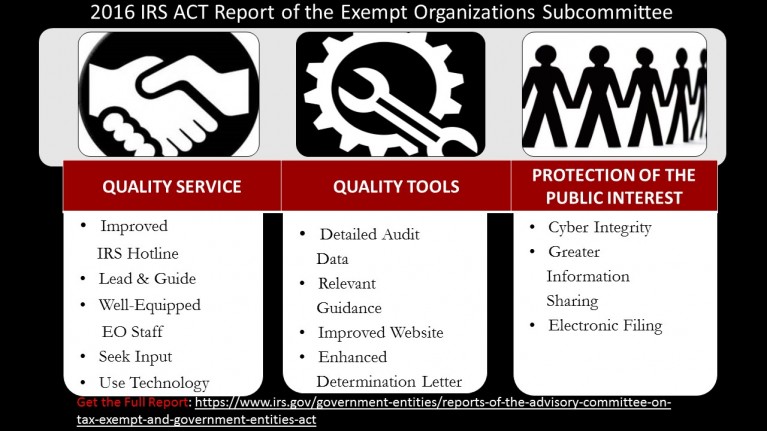

It’s an election year and it’s important for nonprofits to understand what they can and can’t do when it comes to political advocacy. There is a common misconception that nonprofit organizations are legally prohibited from engaging in advocacy or lobbying activities. This is entirely untrue. Nonprofits can advocate and lobby so long as they abide by federal and state regulations. In fact, nonprofits should engage in advocacy in or to represent the interests of the people they serve and “influence public policies that affect the organization’s ability to achieve its mission.” When nonprofits do engage in lobbying and advocacy, expenditures must be disclosed, paid lobbyists or staff that engage in lobbying must be properly registered with the state and Congress if necessary, and most importantly all lobbying and advocacy activities must be nonpartisan. This means that nonprofits may not endorse or imply support for or opposition to a particular candidate or contribute in any way to a political campaign. However, there are numerous ways in which nonprofits can be active during election season, from the provision of nonpartisan study, analysis, or research to the hosting of candidate forums. It is therefore crucial that nonprofits “have a written, board-approved policy on advocacy defining the process by which the organization determines positions on specific issues.” (Standards for Excellence: An Ethics and Accountability Code for the Nonprofit Sector)

More information is available and helpful models and sample are available in the Standards for Excellence educational resource packet, Advancing the Mission through Public Policy which outlines the benefits of advocacy and the limits on and legal requirements for nonprofit lobbying. This educational resource packet and the full series of all packets – including sample policies, tools and model procedures to help nonprofits achieve best practices in their governance and management – can be accessed by contacting a licensed Standards for Excellence replication partner, one of the over 150 Standards for Excellence Licensed Consultants, or by becoming a member of the Standards for Excellence Institute.